The startup ecosystem has gone through some substantial changes over the last few months, and founders need to understand current conditions to properly plan for the future.

I serve the accounting and financial planning needs of more than 750 startups, which provides me with a unique position to help founders stay informed about the different factors that affect funding, valuations, spending, startup management and other trends in the startup economy.

The data in this report is not from a survey — it’s created directly from anonymized accounting data from more than 700 of our clients. As such, it’s not subject to any optimistic thinking bias that so many startup founder surveys have.

Capital is tightening, forcing startups to react

Low interest rates over the last decade have fueled growth and boosted startup valuations across every industry. But in June 2022, the rate of inflation peaked at 9.1%. In response, the Federal Reserve dramatically increased interest rates, bringing easy access to cheap money to an end.

Startups included in this dataset raised more than $4 billion in 2021 but only in the high $2 billion range in 2022 — a dramatic drop.

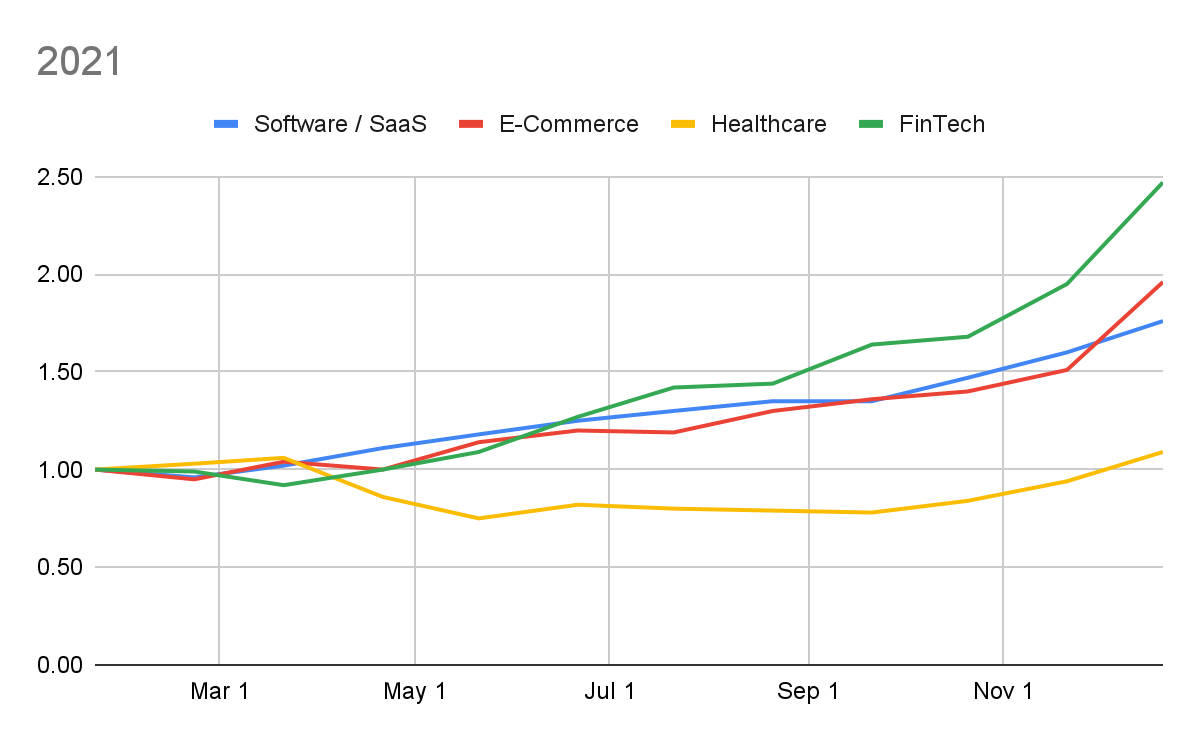

The end of easy money is forcing founders to react. Startups that might have easily gotten venture funding in the past are going to have to get creative to extend their cash runway. The charts below contrast startup revenue, spending and runway in 2021 and 2022 in four sectors: software/SaaS, e-commerce, healthcare and fintech.

Startups are extending their runways

In general, the cash position of most startups remains solid, with some important nuances.

We watch the cash position and runway of our startup clients very closely, as their investors (and savvy founders) deeply care about this metric.

The data in this report is not from a survey — it’s created directly from anonymized accounting data from 700+ of our clients.

At the beginning of 2019, the average startup had 19.6 months of runway. As of Jan. 1, 2023, the average has increased to 23.4 months of runway. This directly reflects the expense reductions seen in 2022, plus the record amounts of funding raised by startups over the past two years.

However, the average can hide some important nuances.

There are other implications to this careful cash management as well — startups may not be in a position to hire, for example. Another expense that startups are aggressively reducing is rent, choosing to embrace remote work — our clients spent about 7% of their expenses on rent pre-COVID, but we’ve seen that expense drop to just over 3% at the beginning of 2023.

Average/median months of runway remaining. Image Credits: Kruze Consulting

Early-stage companies are cutting back

While almost all early-stage companies have reduced their burn rates in 2022, fintech shows the greatest cuts to spending, reflecting the downturn in revenues at the end of 2022. Facing an uncertain economic environment and potential fundraising challenges, startups are clearly looking to extend their runways by reducing expenses.

Founders will need to shift from a “growth at all costs” mentality to focus on sustainable growth. That’s going to require careful cash management and cautious spending.

2021 startup revenue. Image Credits: Kruze Consulting

How well are SaaS, e-commerce, fintech and health tech startups doing in 2023? by Walter Thompson originally published on TechCrunch

Source : How well are SaaS, e-commerce, fintech and health tech startups doing in 2023?