Every day, we see another traditional financial institution scrambling to figure out its crypto strategy, and it’s clear why. Crypto is past the tipping point of mainstream consciousness, and use cases like cross-border payments are firmly outside of the sandbox stage.

Cross-border payments are one of the earliest crypto use cases for obvious reasons. Qualitatively, public blockchains and their native cryptocurrencies are global by nature and built to be secure, censorship-resistant, cheap to transact with (depending on the token) and (possibly most importantly) can settle transactions instantly 24/7/365.

However, it’s taken a few years for crypto to make a significant dent in this $130 trillion a year industry that incumbents — like money-transfer companies and big banks — have held a monopoly on. For example, the vast majority of Western Union’s revenue comes from individual transaction fees from cross-border payments.

It all comes down to crypto having the same or better level of global liquidity than fiat and readily available on-off ramps. Good news: Both these lines are trending positively.

Antiquated systems favor big banks

The world of traditional foreign exchange (FX) has remained fairly stagnant for years — you can only make payments during regular banking hours, and while messages are sent via SWIFT, payments aren’t actually settled until a few days later.

There are at least two distinct steps to this antiquated correspondent banking system, and as we all are painfully aware, transactions are slow, error-prone, costly and inefficient. While there are larger payment flows in corridors such as U.S.-to-Mexico, there are still costs to consumers.

As you move into non G-20 currencies, it’s anybody’s guess as to when your money will arrive from one country to the next, and you’ll be paying fees anywhere from 5%-10%. This system has long served the big-money-center banks that monopolized access to liquidity among themselves, raking in trillions of dollars over the years.

For years (pre-2017), crypto liquidity was limited to a handful of exchanges with a few million dollars in volume across all assets. That’s dramatically changed in the past few years.

Image Credits: Asheesh Birla

Ripple early on focused on the thesis that it will become cheaper to source liquidity for cross-border payments with crypto over traditional fiat if (1) crypto grows in volume around the world (measured by the level of liquidity on exchanges) and (2) you can make bigger payments with it (measured by order book size). What was a lofty vision in 2015 is now reality.

On- and off-ramps are required to access crypto liquidity

A key factor required to use crypto for cross-border payments is easy on- and off-ramps to move from fiat to crypto and vice versa to get access to crypto liquidity. I could once count on one hand the available methods, and today, the different venues, such as stablecoins and exchanges, for moving in and out of crypto are growing quickly. Everyone from the major money transfer companies and card networks to global crypto exchanges is taking advantage of tokenization to address this first hurdle.

Fiat-backed stablecoins have emerged as one of the most popular on- and off-ramps because they ensure a relatively easy way to get access to crypto without having to immediately convert money into fiat when making a payment and therefore eliminating the conversion taxes headache and high volatility in crypto.

This is evident in the growing market cap of stablecoins, which shot up to well over $100 billion in July 2021 from $4 billion in 2019. They provide access and liquidity into crypto exchanges, decentralized finance platforms and less liquid fiat-to-fiat corridors, showing the power of what tokenized assets can do. As the world trends toward tokenizing all kinds of value (fiat, crypto, identity, loans, NFTs, etc.), the more liquidity there is within the system to support moving from one asset to the next.

Getting into the data

Now onto the quantitative reasons — data shows that sourcing liquidity from crypto becomes more cost-effective than fiat over time. The fundamental question is at what data point does sourcing from crypto become consistently cheaper than traditional fiat foreign exchange (FX)?

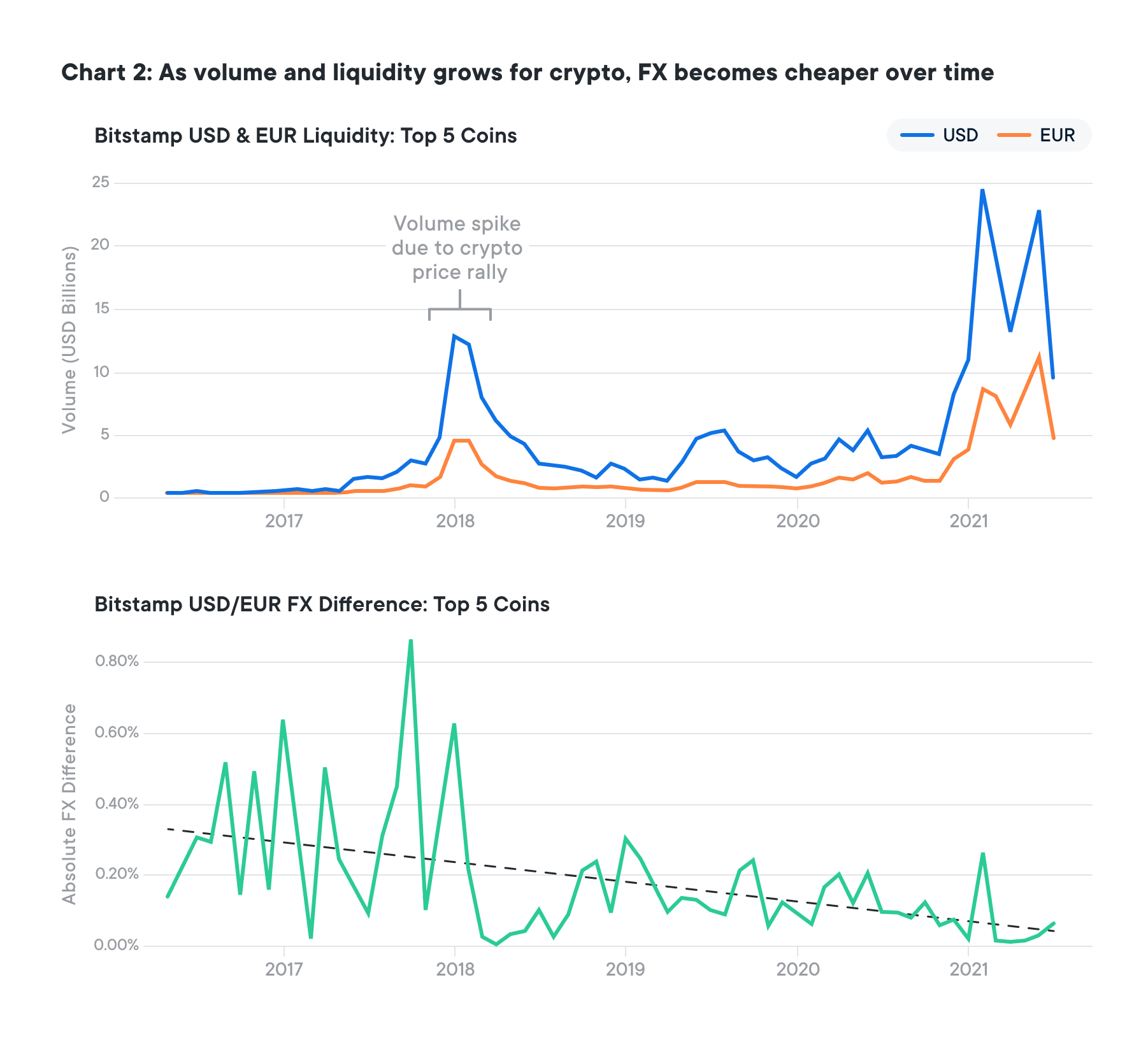

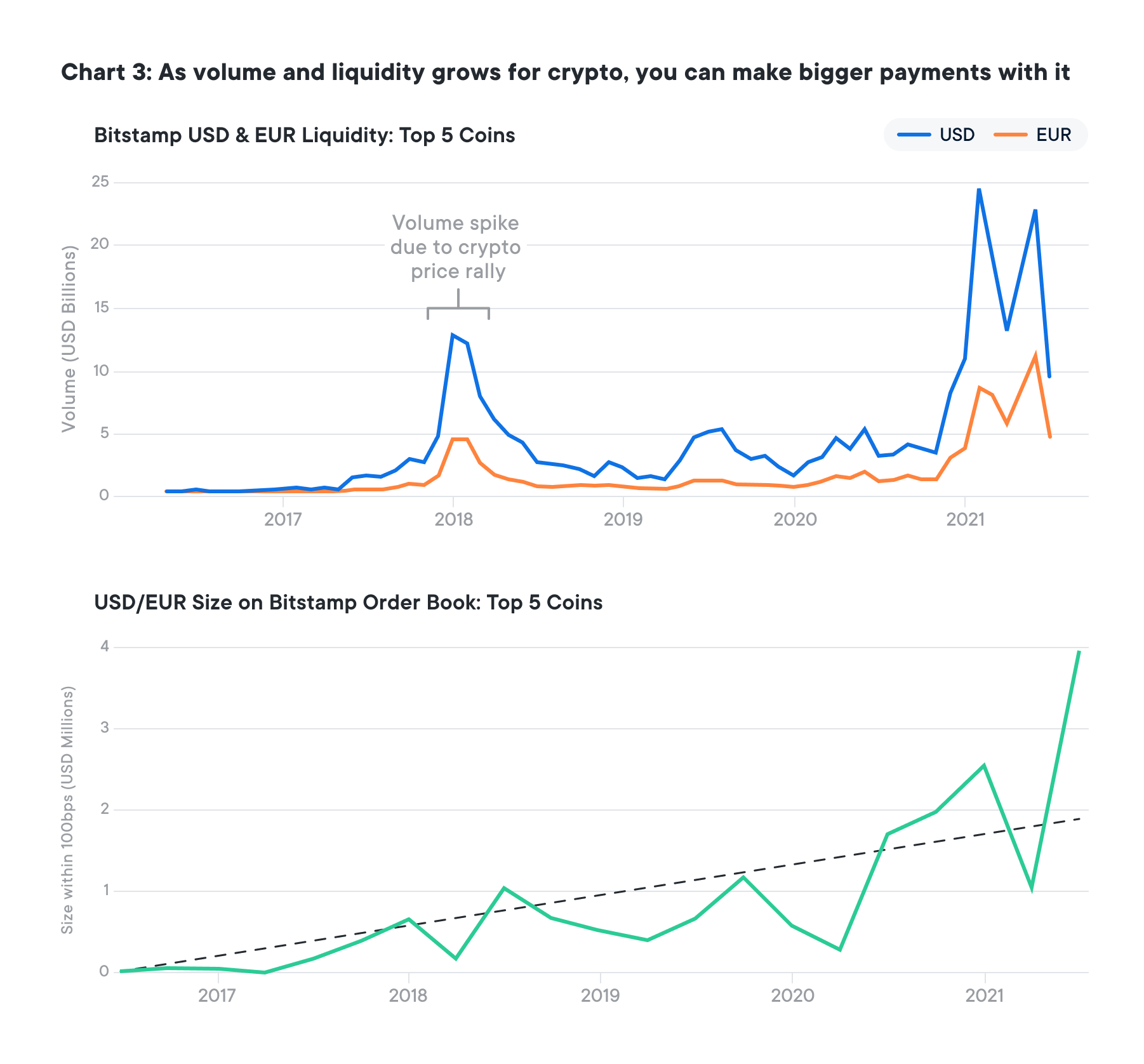

Using the chart below, we can see how crypto volume, an indicator of liquidity, has grown over the past five years by using five of the top cryptocurrencies by market cap (Bitcoin, Ether, XRP, Litecoin and Bitcoin Cash) on Bitstamp as a proxy for the larger crypto market. These assets combined consistently accounted for about 85% of all crypto volume (outside of stablecoins) from 2016 to 2021.

Image Credits: Asheesh Birla

We specifically looked at USD and EUR monthly volume for the five tokens compared to the USD and EUR average difference in spot and implied FX rates, as well as the USD and EUR order book size from April 2016 to June 2021. Spot rate shows the immediate FX rate at that specific moment in time, while implied rate shows the FX rate achieved from bridging sending currency to destination currency with an intermediary (such as using a crypto asset as the bridge).

As the years passed, the difference between the spot FX rate and the implied rate gets closer to zero, evident from the average trend line, meaning it’s becoming on par or cheaper to send payments through crypto than it is with fiat.

Extrapolating the trend line further, we could forecast the trend line going past zero to a negative difference within the next two years (provided crypto volume continues to double at the current rate). It’s also worth noting other factors at play here, such as that payment providers like PayPal or Western Union charge a fee per fiat transaction (between 0.2%-1% margin).

Image Credits: Asheesh Birla

Over the same time period, the chart above shows how order book size is quickly increasing — meaning there’s enough liquidity to support payments as high as $4 million total in 2021 with these five cryptocurrencies.

Traditional transaction-based payments revenue will become obsolete

To all the money-transfer companies that make a huge chunk of their revenue from FX transaction fees, there should be alarm bells going off when seeing this data.

Here’s the reason why companies are pushing to use crypto for cross-border payments — it’s no longer just about the qualities of blockchain and crypto that make it useful for this use case, but also that global liquidity can truly support these payments at scale. As more options are available for consumers, traditional companies will have to lower transaction fees to keep market share, which will partially mitigate the issues.

To all the consumers that have previously gone to PayPal or the like to make a cross-border payment: Why stick with them when it’s cheaper, faster and just as — if not more — secure to use crypto?

These companies will need to change their revenue models, which currently rely heavily on transaction fees, or risk becoming obsolete. While some are going in the opposite direction (i.e., PayPal has already upped its transaction fees for cross-border merchant payments in Europe, and Western Union is pushing further into digital payments to stave off competitors), the proverbial wave is already crashing down. Other services that they provide (compliance, addressing, etc.) will not save them either — many crypto companies are already implementing robust anti-money-laundering and know your customer (AML/KYC) programs.

While this data using BTC, ETH, XRP, LTC and BCH in a few corridors is a proxy for the entire market, the trend lines are directionally obvious. Crypto is above a $2 trillion market cap today — imagine what could be possible when it’s at $5 trillion or $10 trillion.

Crypto liquidity is changing the game. We’re past the “if” — it’s now onto “when.”

Source : Crypto liquidity is ready to eat cross-border payments’ lunch