Today after the bell, Uber reported its fourth-quarter financial performance. The company saw $25.9 billion in gross platform spend, up 51% compared to its year-ago result, and revenues of $5.78 billion, up 83% compared to Q4 2020. The company also reported GAAP net income of $0.44 per share, though that number did include non-operating items relating to investments.

Analysts had expected the company to report a per-share loss of $0.35 against revenues of $5.34 billion, according to estimates shared by Yahoo Finance. Shares of the American company are up just under 6% in the immediate aftermath of its earnings disclosure.

On a per-segment basis, here’s how Uber’s key business units performed in revenue terms:

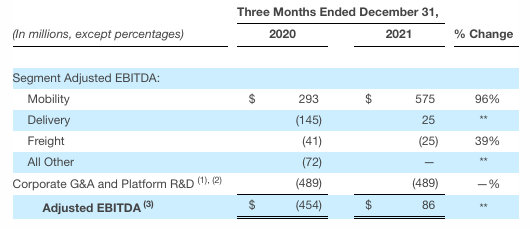

The company’s diversification is in full-force in the above numbers, with ride-hailing posting the slowest growth of Uber’s core unit results, even losing the revenue crown to delivery. However, when it comes to generating heavily adjusted EBITDA, things are rather different:

Here we can see that Uber’s ride-hailing business remains utterly supreme when it comes to the creation of margin for the company’s corporate operations to charge against. In contrast, delivery and freight-focused operations effectively canceled out one another in the quarter. Still, for Uber, posting positive adjusted EBITDA is a useful indication that its business has matured into something less awash in red ink than it once was, helped in no small part by the company’s delivery work shifting its results into the green.

Yesterday, Uber’s rival Lyft reported another quarter of adjusted profitability, and revenues in the fourth quarter that bested expectations. Shares of Uber and Lyft were higher during regular trading.

While the above news is generally positive, by more traditional metrics Uber remains unprofitable. For example, in Q4 2021 the company’s operating income came to -$550 million. However, $1.47 billion in “other” income more than filled that deficit. What was that other income? Per the company, the line item was “primarily due to aggregate unrealized gains related to the revaluation of Uber’s Grab and Aurora equity investments, partially offset by an unrealized loss related to the revaluation of Uber’s Didi equity investment.”

While welcome, those gains won’t persist on a quarterly basis, implying that Uber’s business, once all expenses are factored into its operating results, remains unprofitable. Though less so than before. A good way to view the situation is operating cash burn per year. In 2020, Uber’s operations consumed $2.75 billion; in 2021 the company’s operating cash flow was a far smaller -$445 million.

Guidance

Looking ahead, Uber expects to generate gross bookings of “$25 billion to $26 billion” in Q1 2022, and adjusted EBITDA of “$100 million to $130 million.” The gross bookings (gross platform spend) is flat, to slightly negative compared to Q4 2021 results, while the adjusted EBITDA number is a modest improvement on its fourth-quarter $86 million result.

Of course, more to come after the earnings call, but that’s your first look!

Source : Uber wrapped 2021 with strong revenue growth and greater adjusted profitability