Digital payments giant Paytm, one of India’s most valuable startups, plans to raise up to $2.2 billion in an initial public offering, it said in draft papers submitted to the country’s market regulator on Friday.

The Noida-headquartered firm — backed by Alibaba, Berkshire Hathaway, and SoftBank among others — said (PDF) it will issue new shares worth $1.1 billion and offer sale worth of $1.1 billion.

The startup, which competes with PhonePe and Google Pay in the world’s second largest internet market, plans to use the fresh capital of $577 million to broaden its payments services offering and about $269 million to enter into new initiatives and explore acquisition opportunities, it said.

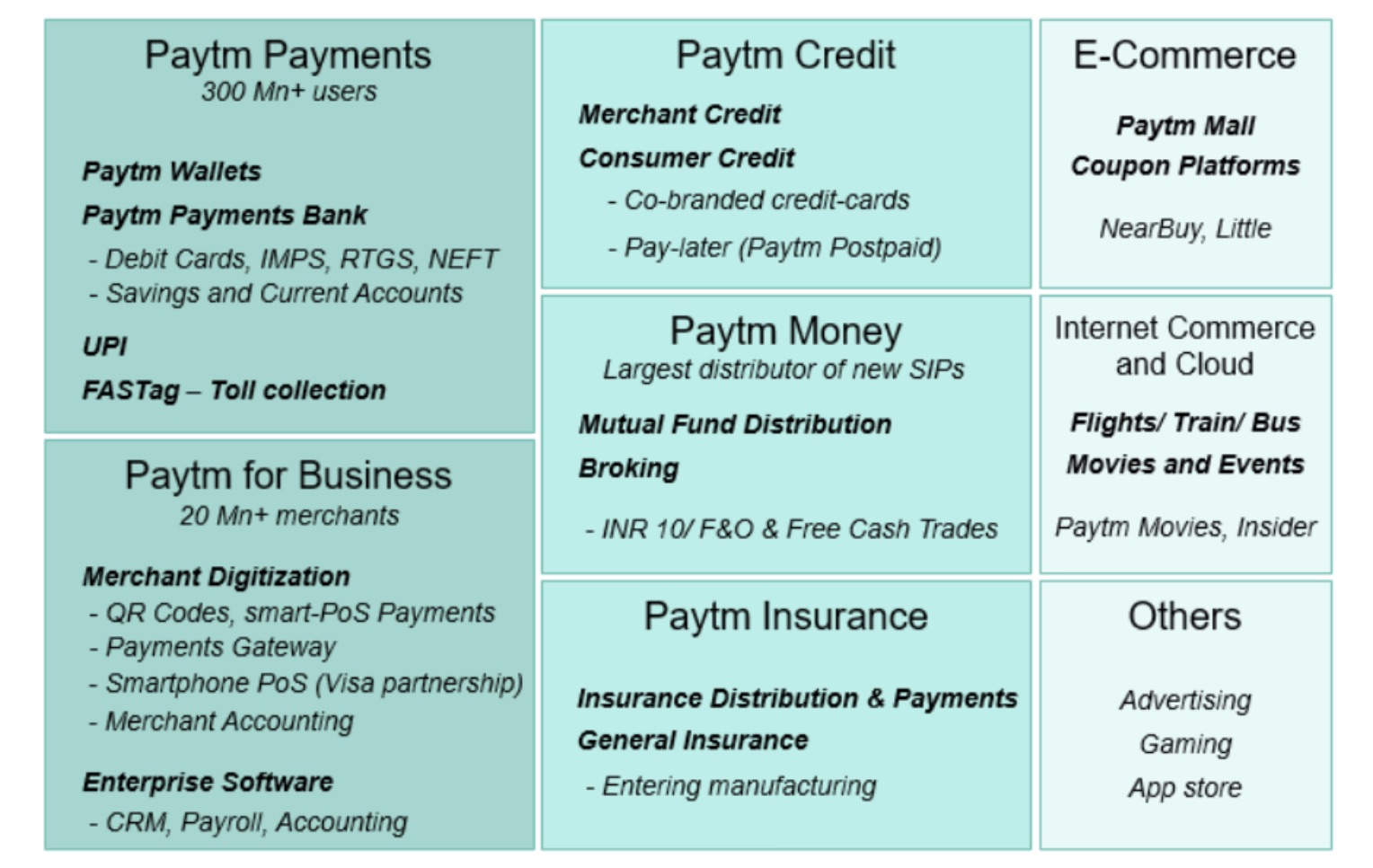

Paytm, which was launched in 2009 to help users easily make digital payments from their phones, has expanded to a wide-range of services in the past decade. Today it operates a payments gateway, e-commerce marketplace, ticket booking, and also sells insurance and digital gold. In several of the categories where it operates, Paytm is a market leader.

The startup, formally known as One97 Communications and last valued at $16 billion, platform has amassed over 333 million users, 114.3 million of whom transact annually, and has onboarded over 21 million merchants, it said in the papers today.

“We have created a payments-led super-app, through which we offer our consumers innovative and intuitive digital products and services,” the Vijay Shekhar Sharma-led describes itself.

A look at Paytm’s numbers shared with market regulator on Friday (Paytm)

“We offer our consumers a wide selection of payment options on the Paytm app, which include (i) Paytm Payment Instruments, which allow them to use digital wallets, sub-wallets, bank accounts, buy-now-pay-later and wealth management accounts and (ii) major third-party instruments, such as debit and credit cards and net banking,”

Paytm’s IPO plans come at a time when the pandemic has fuelled India’s digital economy and local stock exchanges are showing growing appetite for consumer tech stocks. Indian food delivery giant Zomato’s $1.3 billion IPO this week took only a few hours to be fully subscribed by retail and anchor investors.

A lot is riding on a successful IPO of Paytm, one of the most celebrated startups in India and which reported a consolidated loss of $233.6 million for the financial year that ended in March this year, down from $404 million a year ago.

Earlier this week, Paytm’s Sequoia-backed rival MobiKwik also filed for an IPO, in which it is seeking to raise about $250 million. SoftBank-backed e-commerce giant Flipkart, which raised $3.6 billion at $37.6 billion valuation earlier this week, insurance aggregator PolicyBazaar, make-up retailer Nykaa and delivery startup Delhivery, which on Friday announced a $100 million investment from FedEx, may also list in the next three to four quarters.

A look at all Paytm businesses. (Bernstein)

Bankers and analysts are bullish on Paytm, whose mobile wallet business has lost lustre in recent years as UPI — a payments framework backed by banks in India — found takers in Google, PhonePe and others and took the market by storm. But Paytm has bounced back, analysts argue.

“With the advent of UPI, there has been a rising narrative that questioned Paytm’s market leadership,” the analysts wrote, referring to the exponential growth of payments stack developed by retail banks in India that has been adopted by several firms, including Google and PhonePe (as well as Paytm), and which has somewhat lowered the appeal of mobile wallets in India,” analysts at Bernstein wrote in a recent report to clients.

“However, under the hood, Paytm leads on merchant payments and has built an ecosystem of synergistic fintech verticals around its ‘super-app.’ The ecosystem spans payments (wallet/UPI), full-suite merchant acquiring, credit tech, digital bank, wealth, and insurance tech. We believe the super-app battle in India is not a ‘winner takes all’ but a game of execution, business building, and creating a superior customer experience with ecosystem integration,” Bernstein analysts added.

Source : Paytm files for $2.2 billion IPO